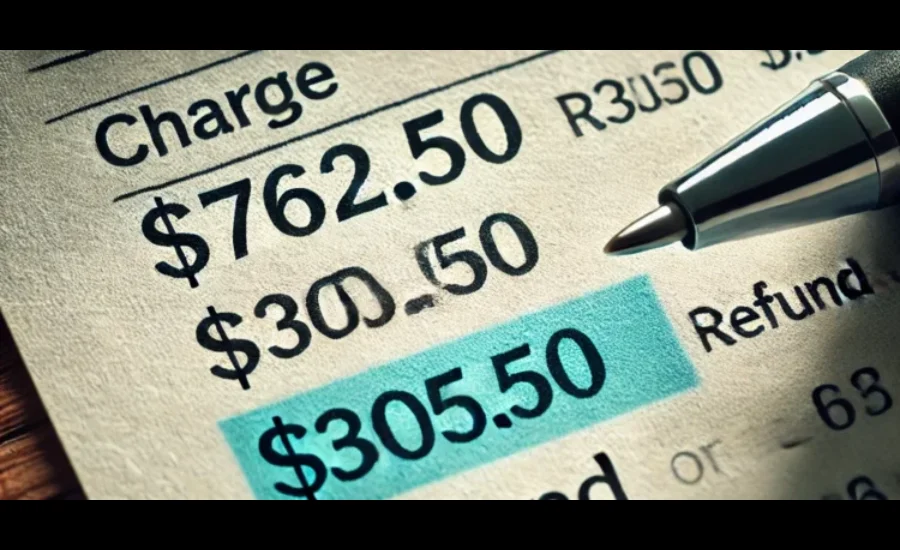

Billed 762.50 Refund To 305.00 adjustments is an essential aspect of maintaining strong customer relationships. Whether it’s adjusting a refund from Billed 762.50 Refund To 305.00 or addressing a different amount, the ability to manage refunds accurately is crucial. A prompt and transparent refund process can significantly impact customer loyalty, satisfaction, and trust. For businesses, understanding how to handle these refund adjustments efficiently is key to avoiding issues and ensuring that both financial records and customer expectations are properly aligned.

This guide will take you through the core concepts of refund adjustments, explain best practices for managing refunds, and offer valuable insights on how to navigate the complexities of refund processing in various customer situations.

Understanding Refund Adjustments: What Does Billed 762.50 Refund To 305.00 Mean?

Refund adjustments are a crucial part of maintaining trust between businesses and customers. When a refund is modified from an amount like Billed 762.50 Refund To 305.00, it signifies a recalculation of the initial refund amount. There are multiple reasons why such changes might happen, including partial returns, service modifications, or correction of overpayments. This process ensures that businesses handle refunds in a manner that is both transparent and in line with their financial practices.

In essence, adjusting the refund is about ensuring accuracy in the transaction while maintaining fairness to the customer. For business owners, understanding how to handle these adjustments not only keeps customer relationships intact but also ensures financial integrity. A properly executed refund adjustment can prevent future misunderstandings and contribute to a positive customer experience.

Why Would Refund Amounts Be Adjusted?

A business may find it necessary to reduce the amount of a refund from the original charge, such as lowering the refund from Billed 762.50 Refund To 305.00. There are several valid reasons for this adjustment, each requiring careful attention to detail and transparent communication with the customer. One common reason for refund reductions is partial returns. Customers may choose to return only some of the items they purchased, which directly impacts the refund amount. For example, if a customer paid $762.50 but returned only part of the purchase, the refund would be adjusted to reflect only the value of the returned items, ensuring the refund is proportional to the return.

Another situation that could lead to a reduced refund is service modifications. In cases where services have been partially rendered or only partially used, such as in subscription-based services, the refund would often be adjusted to reflect the actual usage. For instance, if a customer paid for a full service but used only a portion of it, the refund would typically be recalculated to reflect the value of the service that has already been consumed.

Refunds can also be adjusted when overpayments occur, either due to errors or mischarges. If a customer accidentally paid more than what was required for a product or service, the refund would need to be reduced to the correct amount, ensuring that the customer receives the appropriate compensation. Similarly, discounts or promotions offered after the original purchase may impact the refund amount. In such cases, the refund could be recalculated to account for any changes in the pricing due to those offers.

Finally, certain transactions may involve non-refundable fees, such as shipping costs or processing charges. These fees are often disclosed upfront during the purchase process, and their non-refundable nature can result in a smaller refund than the initial payment. It’s essential to communicate these non-refundable fees clearly to customers at the time of purchase to avoid misunderstandings and ensure the refund amount is correctly adjusted.

The Process of Adjusting Refunds

Adjusting a refund may seem like a complex task, but it becomes much simpler when you follow a structured process. The first step in processing any refund adjustment is to verify the original payment details. This involves checking the transaction records to confirm that the correct amount, such as $762.50 in this case, was originally paid. By double-checking these details, you ensure that no mistakes are made in processing the refund and that the correct amount is being refunded to the customer. This careful verification helps avoid errors that could affect both the customer’s experience and your financial records.

Once the original payment has been verified, the next step is to confirm the reason behind the adjustment. If the refund is being reduced to $305.00, there may be various reasons for this, such as partial returns, service usage, or corrections of overcharges. It’s essential to document the reason for the adjustment clearly. This documentation can be incredibly helpful in case any questions arise from the customer about why the refund amount has been reduced. Keeping a record of the reasoning behind the change ensures transparency and helps protect your business from potential disputes.

Finally, after the payment details have been verified and the adjusted amount has been confirmed, it’s time to process the refund. Depending on the method of payment originally used, the refund can be issued through various payment systems or manually. For online transactions, such as those made through PayPal or credit card payments, you can simply log into the relevant payment platform, find the original transaction, and adjust the refund amount accordingly. Once the refund amount is updated to $305.00, confirm the transaction and ensure that a copy is saved for your records. Keeping a copy of the transaction will help maintain accurate accounting and provide proof of the refund in case of any future issues or audits. This careful, step-by-step approach ensures that refunds are processed accurately and efficiently while maintaining good customer relations.

Common Refund Mistakes to Avoid

To ensure smooth refund adjustments, businesses must carefully review all the details before confirming any transaction. This includes double-checking the adjusted refund amount, understanding the reason for the change, and verifying all relevant customer information. Taking the time for a final review can prevent costly mistakes and avoid potential customer dissatisfaction. A thorough review helps ensure that the process is accurate and aligns with the company’s refund policy, which in turn prevents issues and ensures a positive customer experience.

In addition, documenting each step of the refund process is essential for maintaining clarity and protecting your business. Whether through digital receipts, system logs, or physical records, it is important to maintain a clear and comprehensive transaction history. This documentation serves as evidence in case of future audits or disputes, ensuring that the business has a reliable record of every refund transaction and the reasons behind any adjustments made.

Maintaining open and clear communication with customers is also a vital part of the refund process. Businesses should always provide clear explanations for any refund adjustments, such as a reduction from $762.50 to $305.00. By keeping customers informed about the reasons for the changes, businesses can ensure transparency and foster trust. This approach helps prevent misunderstandings, promotes customer satisfaction, and supports long-term positive relationships with customers.

Best Practices for Seamless Refund Adjustments

To ensure smooth refund adjustments, businesses should carefully review the refund details before confirming any transaction. This includes double-checking the adjusted refund amount, the reason for the change, and any relevant customer information. A final review can prevent costly errors and customer dissatisfaction.

Documenting each step of the refund process is also crucial. Whether through digital receipts, system logs, or physical records, maintaining a clear transaction history safeguards your business and provides necessary documentation in case of audits or disputes.

Clear communication with customers is essential throughout the refund process. Always explain the reasons for adjustments, such as reducing the refund from $762.50 to $305.00, to ensure transparency and foster trust. This approach helps maintain positive customer relationships.

Why Refund Policies Matter

Having a clear refund policy is crucial for managing customer expectations and protecting your business. A well-defined refund policy can boost customer confidence and reduce the likelihood of misunderstandings.

A comprehensive refund policy outlines the circumstances under which refunds are granted, the timeframe for returning products or services, and any exceptions to the refund rules. If your refund process includes adjustments like reducing a refund from $762.50 to $305.00, ensure that the policy is clear and easily accessible to customers.

Developing a Clear Refund Policy

Refund scenarios can vary depending on the situation. When a customer requests a full refund, it’s essential to ensure that all conditions of the refund policy are met. Verify the purchase details and check that the request aligns with the terms in the policy. Be sure to document the transaction for future reference to avoid potential disputes.

If only part of the product or service is returned or used, the refund should be calculated accordingly. Communicate any deductions to the customer clearly to prevent misunderstandings and ensure they understand the adjusted refund amount.

Handling Different Refund Scenarios

Refund scenarios can vary depending on the situation. When a customer requests a full refund, it’s important to ensure that all conditions of the refund policy are met. Verify the purchase details and confirm that the request aligns with the terms outlined in the policy. Document the transaction thoroughly for future reference to avoid any potential disputes.

In cases where only part of the product or service is returned or used, the refund should be calculated proportionally. It’s crucial to communicate any deductions clearly to the customer to prevent misunderstandings and ensure they are aware of the adjusted refund amount.

Managing Refund Challenges

Refunds are not without their challenges. Some common issues businesses face include refund fraud and disputes over refund amounts. Implement fraud detection measures, such as monitoring unusual transaction patterns and requiring proof of purchase, to reduce these risks.

Additionally, always maintain open communication with customers when disputes arise. Address their concerns promptly and professionally to preserve your reputation.

Also Read: 9105166393

Final Words

Handling refund adjustments is crucial for maintaining strong customer relationships and ensuring business integrity. Whether adjusting a refund from $762.50 to $305.00 or for other reasons, it’s essential to manage refunds transparently and efficiently. Common reasons for adjustments include partial returns, service modifications, overpayments, or non-refundable fees. A structured refund process helps ensure accuracy, customer satisfaction, and proper documentation.

Businesses should verify original payment details, clearly communicate the reasons for any adjustments, and process the refund promptly. Maintaining a clear refund policy and documenting each step is essential for avoiding misunderstandings and protecting the business from potential disputes. Additionally, open communication with customers fosters trust and transparency, which is key to building long-term relationships. By following best practices, businesses can efficiently handle refund adjustments, ensuring customer loyalty and financial accuracy.

FAQs

1. What are refund adjustments?

Refund adjustments refer to changes made to the original refund amount, often due to reasons like partial returns, service usage, or overpayment corrections.

2. Why might a refund be reduced from the original amount?

Refunds can be reduced for reasons such as partial returns, service modifications, overpayment corrections, or the presence of non-refundable fees like shipping costs.

3. How can I verify the original payment before processing a refund adjustment?

To verify the original payment, check the transaction records or receipts to confirm the exact amount paid by the customer before proceeding with the refund.

4. What should be documented during the refund process?

Documentation should include the reason for the refund adjustment, any related transaction details, and proof of communication with the customer about the adjustment.

5. How can I handle partial returns effectively?

For partial returns, calculate the refund based on the value of the items returned, ensuring the customer is refunded accordingly.

6. What if a customer disputes the refund amount?

If a customer disputes the refund, review the transaction details and communicate clearly about the reasons for the adjustment, addressing any concerns professionally.

7. Can a refund adjustment be made for services already consumed?

Yes, for services that have been partially used, a refund can be adjusted to reflect the value of the service consumed, ensuring fairness to both parties.

8. How do non-refundable fees affect a refund?

Non-refundable fees, like shipping costs or processing charges, are subtracted from the refund amount as they are clearly stated in the terms of the sale.

9. What steps should be taken to avoid refund mistakes?

To avoid mistakes, carefully review the refund details, verify payment amounts, and document the reason for any adjustments before confirming the refund.

10. Why is clear communication important during the refund process?

Clear communication ensures transparency, prevents misunderstandings, and helps maintain customer trust by explaining the reasons for any refund adjustments.

For unbeatable refund solutions and transparent service, trust Gravity Internet Net – where we turn confusion into clarity.